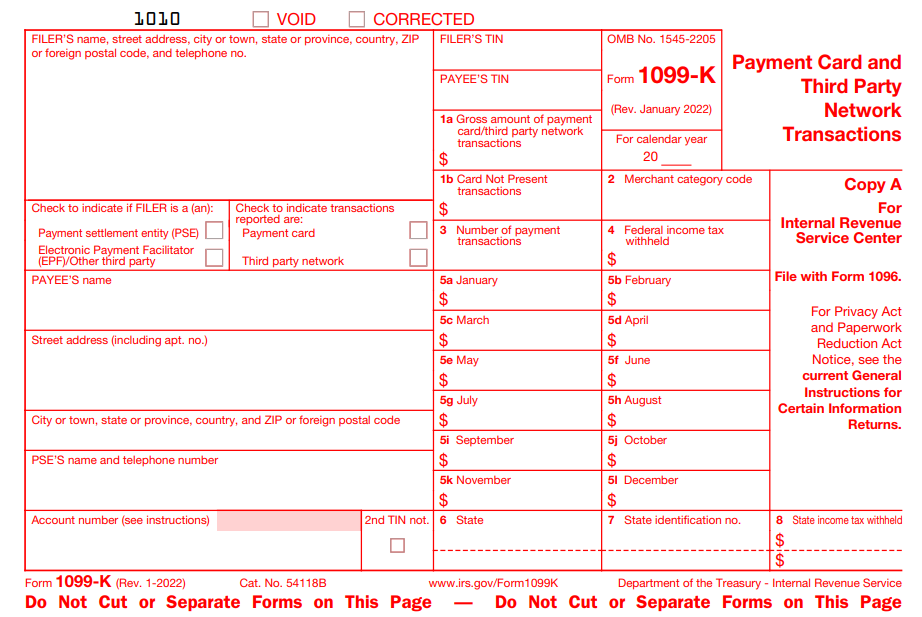

File 1099-K Form Online for 2023

Simple, Secure and Accurate

E-file Form 1099-K NowPricing starts as low as $0.80/form

What are the Changes in the 1099-K Threshold for 2023

Tax Year?

The IRS introduced new changes in the 1099-K Threshold & transaction limits for 2023 tax year. The IRS is now required to report 1099-K Form if the reportable gross payment exceeds $600, regardless

of the number of transactions.

| Changes | 2022 Tax Year | 2023 Tax Year |

|---|---|---|

| Threshold Limit | $20,000 | $600 |

| Transactions | 200 | N/A |

Visit https://www.taxbandits.com/1099-forms/new-form-1099-k-changes/ to learn more.

How to File Form 1099-K Online for 2023 Tax Year

E-file Form 1099-K in 3 simple steps with our easy e-filing solution!

Enter Form 1099-K Information

Enter the filer and payee details including name, address, and fill out the applicable fields.

Review Form 1099-K Information

Review the information provided and transmit the return to the IRS

Transmit the Form to the IRS

Pay & transmit your forms to the IRS and get the filing status in minutes.

Benefits of Filing Form-1099 K Online

When you File any 1099 Form online, you can take advantage of all these benefits.

Instant IRS Updates

You get instant IRS updates on the status of the forms you file. You can check the status of your filings at any time.

Postal Mail & Online Access

Choose postal mailing services for recipient copies or allow the recipients to have online access through a secure portal.

Bulk Uploads

Upload a high volume of forms through our bulk upload feature and e-file with the IRS instantly.

TIN Matching

We check your payee’s TIN against the IRS database for accuracy and to eliminate the need for filing correction forms.

Built-in Error Checks

We have built-in error checks to ensure there are no errors in your forms before transmitting them to the IRS.

Print Form Copies

There is an option to download and print form copies. Forms can always be accessed and printed from the Distribution Center.

When is the Deadline to File Form 1099-K for the 2023 Tax Year?

The deadline to file Form 1099-K for the 2023 tax year are given below:

Recipient Copy

January 31, 2024

IRS E-File

April 01, 2024

IRS Paper Filing

February 28, 2024

Visit https://www.taxbandits.com/1099-forms/form-1099-k-due-date/ to learn more.

Ready to E-File Form 1099-K?

Filing your Form 1099-K should be easy and secure. Complete your form and get instant IRS status updates.

Contact Us

Do you have additional questions about e-filing Form 1099-K?

Email us at: Support@TaxBandits.com

Phone: 704.684.4751

Frequently Asked Questions on

Form 1099-K

Other Supported Forms

- Form 1099-MISC, Form 1099-NEC, INT, DIV, R, S, G, C, B, PATR & other 1099 Forms

- Form 1095-B/C, Form 1094-B/C

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Helpful Resources for Form 1099-K

Form W-9: Request for Taxpayer Identification Number

and Certification

Invite your vendors to complete and

e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form. With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

.png)

.png)